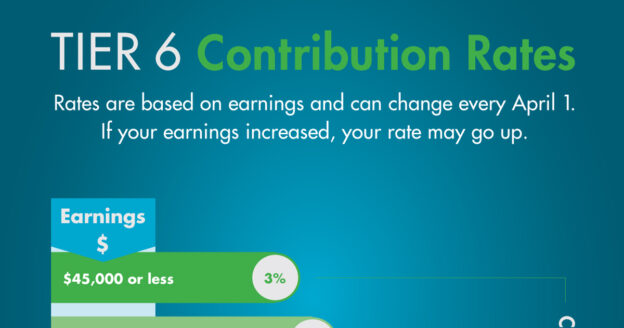

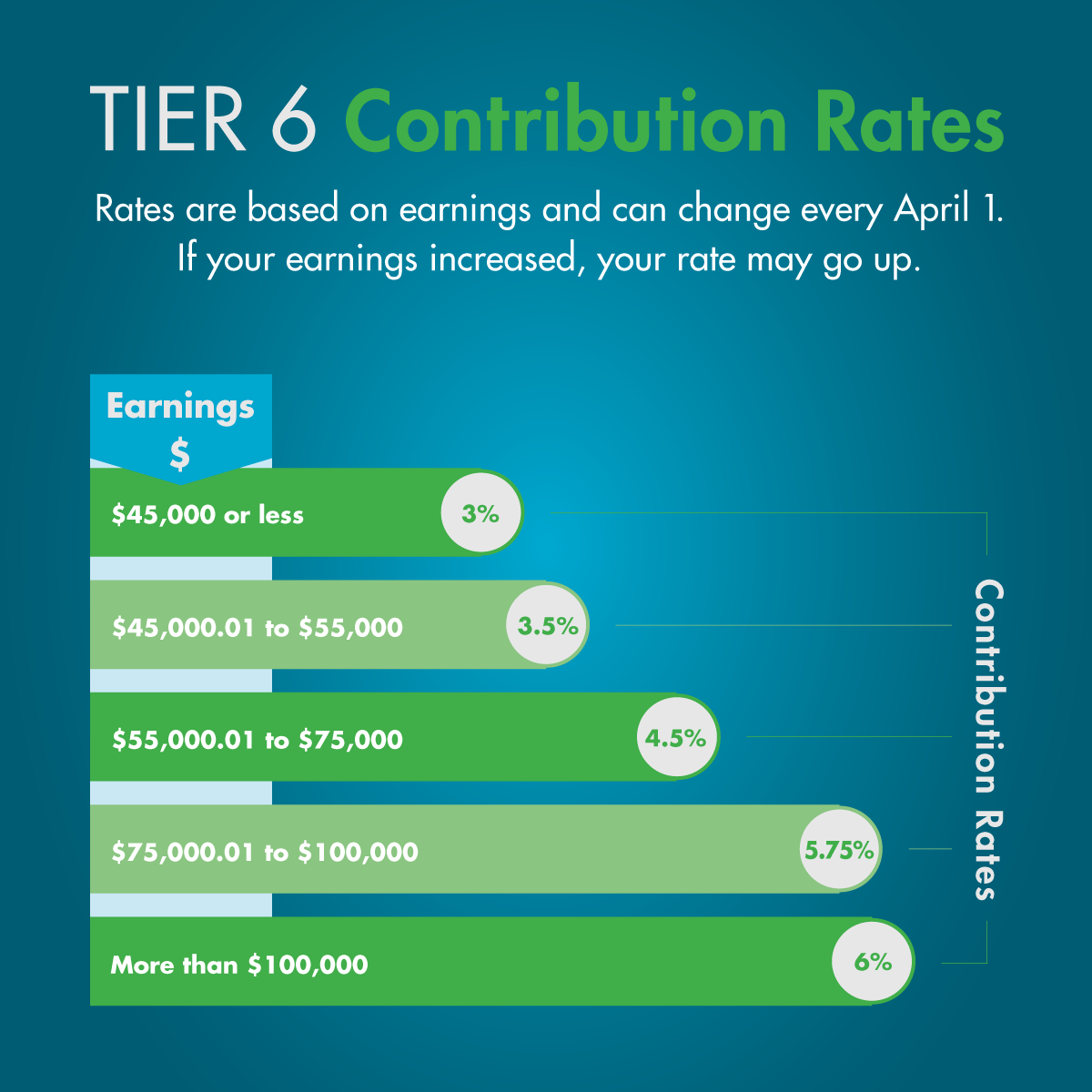

Most NYSLRS members contribute a percentage of their earnings to help fund pension benefits. For Tier 6 members (those who joined NYSLRS on or after April 1, 2012), that percentage, or contribution rate, can change from year to year based on your earnings. The minimum rate is 3 percent of your earnings, and the maximum is 6 percent.

When Tier 6 Contribution Rates are Determined

A Tier 6 member’s contribution rate is calculated annually. New rates become effective on April 1, the beginning of the state’s fiscal year. Once your rate is determined for a given fiscal year, it doesn’t change for the rest of that fiscal year. We provide rates to your employer in March, a few weeks before they need to apply any rate changes.

How Your Tier 6 Contribution Rate is Calculated

If you are a new NYSLRS member, during your first three years of membership your contribution rate is based on an estimated annual wage that your employer provided when you were enrolled as a new member.

If you have been a member for three or more years, NYSLRS calculates your rate using the earnings reported to us by your employer from the last completed fiscal year, April 1, 2022 through March 31, 2023.

Rates are calculated using your base pay, which includes:

- Regular earnings

- Holiday pay

- Longevity pay

- Overtime pay (up to a certain limit)

Update for 2024: Overtime is no longer excluded from the Tier 6 contribution rate calculation.

Legislation enacted during the COVID-19 emergency temporarily removed overtime from the Tier 6 contribution rate calculation. For some Tier 6 members, this meant lower contribution rates for up to two years, from April 1, 2022 through March 31, 2024.

Beginning April 1, 2024, overtime will be included in the calculation of contribution rates.

This video will help explain how your contribution rate is determined:

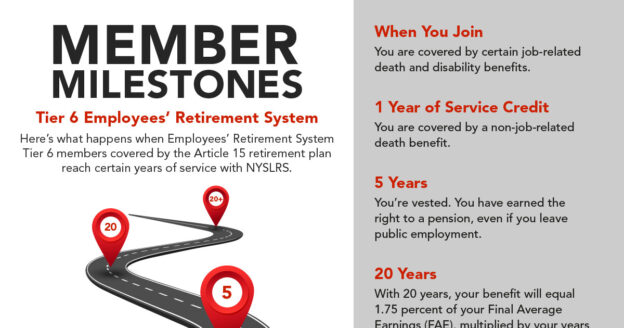

How Your NYSLRS Pension Works

The amount you contribute to the Retirement System does not affect the amount of your pension. A NYSLRS pension is a defined-benefit plan. Under this type of plan, once you are eligible for a pension and apply for retirement, you will receive a monthly payment for the rest of your life. The amount of your pension will be calculated using a formula based on your retirement plan, years of service and final average earnings.

You can learn more about how your pension will be calculated by reading your retirement plan publication. Use our Find Your NYSLRS Retirement Plan Publication tool to find yours.