While most New York teachers and administrators are in the New York State Teachers’ Retirement System, other school employees are members of the New York State and Local Retirement System (NYSLRS). In fact, 1 out of 5 NYSLRS members works for a school district. Usually, their employment is tied to the school year, which is often 10 or 11 months long.

While most New York teachers and administrators are in the New York State Teachers’ Retirement System, other school employees are members of the New York State and Local Retirement System (NYSLRS). In fact, 1 out of 5 NYSLRS members works for a school district. Usually, their employment is tied to the school year, which is often 10 or 11 months long.

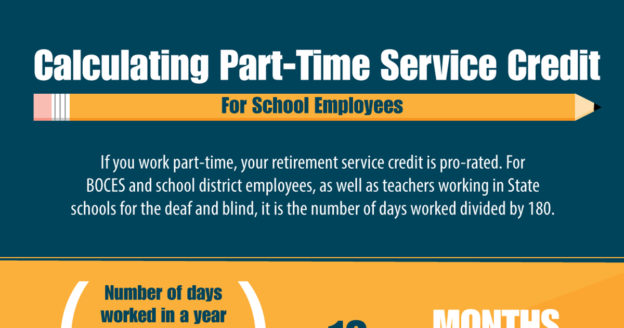

So how do we determine service credit for school employees?

Service Credit for School Employees

As a member, you receive service credit for paid public employment beginning with your date of membership. That credit is based on the number of days you work, which your employer reports to us.

If you’re working full-time, you receive one year of service per school year, even if you only work 10 months of the year.

For part-time work, your employer calculates days worked by dividing the number of hours worked by the hours in a full-time day. The number of hours in a full-time day is set by your employer (between six and eight hours). So, for example, if a 40-hour work week is considered full-time for your employer, and you work 20 hours a week for a given school year, you will receive half a year of service credit.

Calculating Service Credit

Usually, a full-time, 10-month school year is at least 180 days. However, depending on your employer, a full academic year can range from 170 days to 200 days. Whether you work full- or part-time, your service is based on the length of your school year:

For all BOCES and school district employees, as well as

teachers working at New York State schools for the deaf and blind:

Number of days worked ÷ 180 days

For college employees:

Number of days worked ÷ 170 days

For institutional teachers:

Number of days worked ÷ 200 days

Check Your Service Credit

You can sign in to Retirement Online and find your current estimated service credit listed on your Account Homepage under ‘My Account Summary.’

If you’re not sure whether you’re earning full-time or part-time service, you can check your most recent Member Annual Statement to see how much service you earned over the past fiscal year. To view your most recent Statement, sign in to Retirement Online. From your Account Homepage, click the “View My Member Annual Statement” button under ‘My Account Summary.’ If you are receiving full-time service, it will say “1.00 Years” for service credited from 4/1/2022 – 3/31/2023. A reminder: the total credited service you will see listed on your Statement was as of March 31, 2023.

For more information about service credit, read our booklet Service Credit for Tiers 2 through 6 (VO1854) or find your retirement plan publication.

Why isn’t the medicare paid for if you retire in the school system

NYSLRS doesn’t administer health insurance programs for its members or retirees. Your employer’s health benefits administrator should be able to answer your questions.

Why aren’t full time substitutes in the retirement system ? They perform such a necessary role ….

We recommend that you check with your employer’s human resources (personnel) office for questions about your eligibility for retirement benefits.

I worked 7/1/90-6/30/92 school year as a teacher aide and was credited with only 8 months but am now receiving 12 month credit as a teaching assistant. Is there a ways to purchase or be credited with the extra 4 months?

School employees who work full-time earn one year of service credit per school year. Part-time work is prorated. You can find more information in our How School Employees Earn NYSLRS Service Credit blog post.

For account-specific information about how this may apply in your situation, please message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

Back in the 1990s, I worked for a school district part time as a computer technician for about a year (I was the only person in school district that did that type of work). The school district “terminated” my employment and “re-hired” me as a full-time consultant doing all their networking, user desktop problems and deploying their Student Management System throughout the school district. Whether as an part-time employee or full-time consultant, I did the same time of work, worked regular hours and reported to someone at the school district each morning. The school district was my only “client”. I was able to buy back the part-time work because I was an employee, but is there any chance I can buy the consultant work time back ? Basically because the school didn’t want to pay for benefits I did not have the title of “full-time employee”. Thanks for your answer in advance.

For account-specific questions about purchasing credit for previous service, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

will I earn service credit between April 1 2022 and July 1 2022 if I am a full time BOCES employee?

Generally, if you are being paid by your employer, you receive service credit for your time worked.

For account-specific information about your service credit, we recommend that you email our customer service representatives using the secure email form on our website. One of them will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

What happens if the work 12 months or more out of the year? Is it possible to earn more than 1 year in a window for a teacher?

Example: 10 months of teaching in a high school but also teaching as an adjunct at a SUNY campus at night receiving 4 months of credit in the same time.

You cannot earn more than one year of service credit in a 12-month period.

Thank you. What happens to the additional time above the 10 months? If 10 months equals 1 year, does 12 months still equal one year? To me it seems to de-incentivize working past the 10 month mark. Does the remainder carry forward in the event that I only work 8 months the new year? Logically, it would seem the best answer is to just add up all the months worked at the end and divide by 10. Is that what happens?

You can only earn one year of service credit in a single year. Whether you work 10 months or 12 months in 2022, your maximum service credit for this year will be one year. You cannot carry over service credit to another year.

For account-specific information about how this applies in your situation, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

Teachers work about 8 or 9 months per years and should not receive one year of service

Teachers work 10 months per year.