As a NYSLRS member, you may be making or have made contributions as part of your membership. When you make contributions, a percentage of your salary joins a pool of money called the Common Retirement Fund (the Fund). The Fund is also made up of employer contributions and investment income. By investing contributions, the Fund helps to meet its obligation of paying out benefits to past, present and future retirees.

What this means for you is that you, and other members like you, are all doing your part to fund your future retirement.

Types of Member Contributions

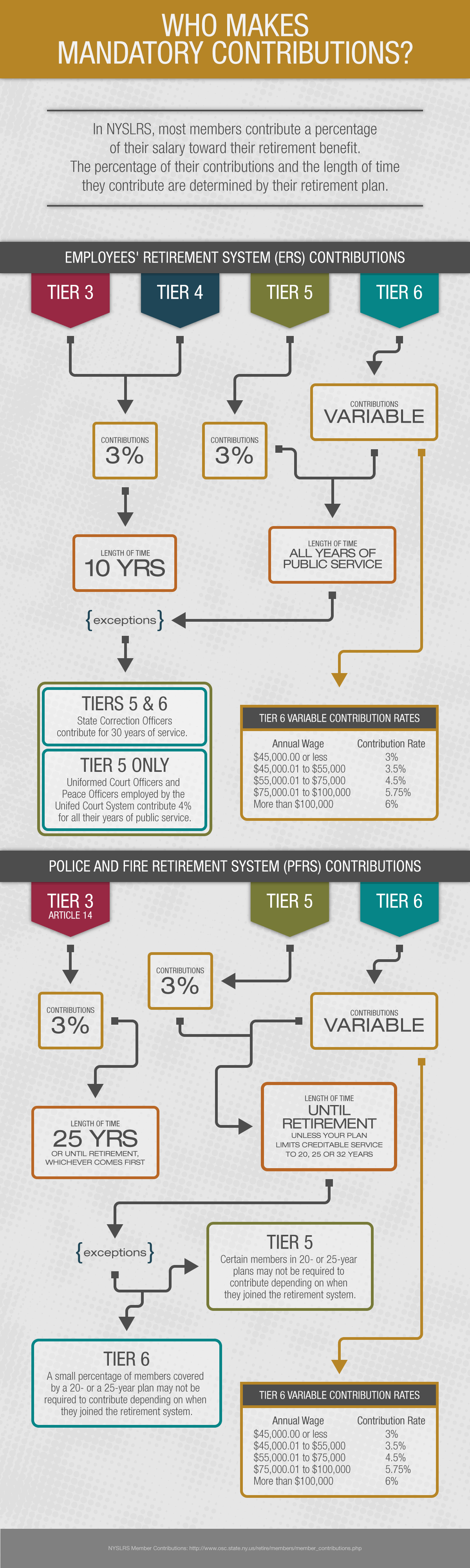

If you belong to a contributory retirement plan, you make required contributions. This means you must make contributions for the length of time listed in your retirement plan. Some members may contribute for only part or all their public service careers. If you belong to a non-contributory plan, this means you aren’t required to make contributions. Instead, you could make voluntary contributions over the course of your career, if your plan allows it. This would provide you with an annuity in addition to your pension when you retire.

(Check out the “Contributing Toward Your Retirement” section in your specific retirement plan publication to see what contributions you make.)

Withdrawing Your Member Contributions

What happens to your contributions if you leave public employment? One option is to take your contributions with you. If you have less than ten years of service credit or aren’t vested, you can withdraw your contributions plus the interest they’ve earned. However, withdrawing your contributions also terminates your membership with NYSLRS. Once your membership ends, you won’t be eligible for a retirement benefit.

Another option is to leave your contributions where they are. After all, if you leave public employment, there’s a chance you may return as well. If you do, then your contributions will be waiting for you when you rejoin NYSLRS. If you don’t return to public service, aren’t vested, and have been off the public payroll for seven years, by law we must terminate your membership. Any contributions left will stop accruing interest.

If you have ten or more years of service credit, you can’t withdraw your contributions from NYSLRS. In that situation, if you’re vested before you leave public employment, you can apply for a retirement benefit at a later date (age 55 for most members).

(Read our publication “What If I Leave Public Employment?” for more information, particularly the taxability of withdrawing your contributions.)

If you have questions, visit our website to learn more about member contributions. Want to read more NYSLRS Basics? Check out our earlier posts on:

“You also should be aware that a refund of your voluntary contributions may constitute income for federal tax purposes in the year it’s paid. If so, NYSLRS will report the amount to the Internal Revenue Service.”

How are these voluntary/excess contributions taxed a second time? I understand that they earn 3-5% interest, and that the member should pay taxes on those earnings. But why would they be reported as income a second time? The member already paid tax on this income, as they are POST TAX contributions….no?

NYSLRS taxes excess contribution refunds in accordance with Internal Revenue Service (IRS) regulations for distributions from a qualified plan before the annuity start date (see IRS Publication 575).

What are the terms of the annuity? Specifically, what is the formula used to determine annual annuity payment?

Does the annuity continue upon the member’s death in the same manner as their pension?

If you have annuity savings contributions on deposit, you can elect the Cash Refund – Contributions payment option at retirement. This option will provide you with a reduced monthly benefit for your lifetime. At your death, the unpaid balance of your accumulated annuity savings contributions will be paid to your beneficiary or your estate. If all of your accumulated annuity savings contributions have been expended, all payments will cease upon your death. The mandatory contributions made by Tier 3 (Article 14), 5 and 6 members are not annuity savings contributions.

For questions about how an annuity is included in your retirement benefit, please email our customer service representatives using the secure email form on our website. One of them will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

Do you have any further information about Annuity contributions for Tiers that do not have a mandatory contribution (Tier 2 for example)? What is the interest rate paid on the annuity, and what are the rules for withdrawing money from the annuity before and/or after retirement? Thanks.

The interest rate on voluntary contributions is 3 percent through the fiscal year (April 1-March 31). If the contributions remain on deposit on March 31, you’ll receive an additional 2 percent interest, for a total of 5 percent.

You can withdraw your voluntary contributions any time prior to your retirement. Any contributions on deposit at retirement will provide you with an annuity. You can only begin, change or withdraw contributions once in any 12-month period. (You can stop voluntary contributions at any time.)

You also should be aware that a refund of your voluntary contributions may constitute income for federal tax purposes in the year it’s paid. If so, NYSLRS will report the amount to the Internal Revenue Service.

The forms for beginning, ending and withdrawing voluntary contributions are available on our website. They have detailed information about contribution options, payment options, tax information and more.