Tier 3 and 4 members in the Article 15 retirement plan qualify for retirement benefits after they’ve earned five years of credited service. Once you’re vested, you have a right to a NYSLRS retirement benefit — even if you leave public employment. Though your pension is guaranteed, the amount of your pension depends on several factors, including when you retire. Here is some information that can help you determine the right time to retire.

Three Reasons to Keep Working

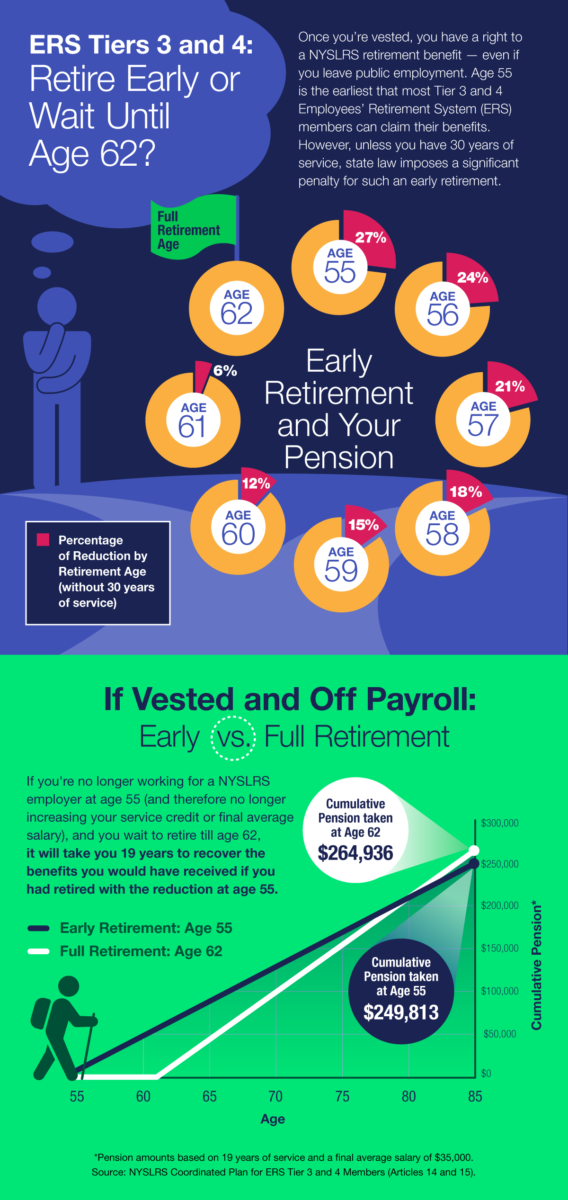

- Tier 3 and 4 members can claim their benefits as early as age 55, but they’ll face a significant penalty for early retirement – up to a 27 percent reduction in their pension. Early retirement reductions are prorated by month, so the penalty is reduced as you get closer to full retirement age. At 62, you can retire with full benefits. (Tier 3 and 4 Employees’ Retirement System (ERS) members who are in the Article 15 retirement plan and can retire between the ages of 55 and 62 without penalty once they have 30 years of service credit.)

- Your final average earnings (FAE) are a significant factor in the calculation of your pension benefit. Since working longer usually means a higher FAE, continued public employment can increase your pension.

- The other part of your retirement calculation is your service credit. More service credit can earn you a larger pension benefit, and, after 20 years, it also gets you a better pension formula. For Tier 3 and 4 members, if you retire with less than 20 years of service, the formula is FAE × 1.66% × years of service. Between 20 and 30 years, the formula becomes FAE × 2.00% × years of service. After 30 years of service, your pension benefit continues to increase at a rate of 1.5 percent of FAE for each year of service.

If You’re Not Working, Here’s Something to Consider

Everyone’s situation is unique. For example, if you’re vested and no longer work for a public employer, and you don’t think you will again, taking your pension at 55 might make sense. When you do the math, full benefits at age 62 will take 19 years to match the money you’d have received retiring at age 55 — even with the reduction.

An Online Tool to Help You Make Your Decision

Most members can use Retirement Online to estimate their pensions.

A Retirement Online estimate is based on the most up-to-date information we have on file for you. You can enter different retirement dates to see how those choices would affect your benefit, which could help you determine the right time to retire. When you’re done, you can print your pension estimate or save it for future reference.

If you are unable to use our online pension calculator, please contact us to request a pension estimate.

This post has focused on Tier 3 and 4 members. To see how retirement age affects members in other tiers, visit our About Benefit Reductions page.

When computing the Final Average Salary (FAS) is unused vacation time subject to the 10% cap from the average of the prior 2 years earnings for Tier 4 employees?

Yes, payment for unused vacation time would be included in calculating the 10 percent limit for Tier 4 members.

For account-specific information about how this may apply in your situation, you can message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

Dear NYSLRS

I have my 30 years of service in ERS, in Tier 4 and my age is above 55 years old. So currently, I work fulltime at a school district as a non-instructional employee, and plan to retire in the next several months. The school district may be willing to consult out one of my duties, as a part time consultant. I realize that those who retire under 65 years of age, can earn up to $35,000 per calendar year without penalty in public service in NYS. How long do I have to wait for after I am off the school district’s payroll, that I can work for the school district as a part-time consultant?

We recommend that you message our customer service representative using our secure contact form for information specific to your situation. Filling out the secure form allows them to safely contact you about your personal account information.

It would have been helpful to answer this for everyone even if it was a generic answer

The rules and restrictions for working after retirement depend on:

• The type of retirement benefit you are receiving (service or disability);

• The employer you will be working for (private, public, yourself, etc.);

• Your date of membership and tier; and

• Your age.

You can find general information in our publication, Life Changes: What If I Work After Retirement?

If you have questions about your particular situation, we recommend you message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

Where can i find info about differences in pension calculation when retiring in a month with 3 paydays? Is there a difference when compared to retiring in a month with 2 paydays?

Thank you.

Most NYSLRS members can quickly create pension estimates using Retirement Online. Your estimate will be based on the most up-to-date account information we have on file for you. You can enter different retirement dates to see how those choices would affect your benefit and adjust your earnings or service credit if you anticipate a raise or plan to purchase past service.

For account-specific questions about your retirement date, we recommend that you contact our customer service representatives using the secure contact form on our website (http://www.emailNYSLRS.com). Filling out the secure form allows them to safely contact you about your personal account information.

Is there anything being done for Tier 6 folks, and if so when?

I applied for my service retirement at 70 days before my official retirement day. I have already retired but my Retirement Online Account says my Retirement Service is on HOLD!

Is this because they have not finished calculating my sick and lump sums. My official Retirement was July 6th.

For questions about your retirement status, please call our customer service representatives at 866-805-0990, press 2, then follow the prompts. You can also message them using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

What does the term Vested mean? And how long does it take to become vested?

Being vested means that you have earned enough service credit to qualify for a pension benefit once you meet the minimum age requirements established by your retirement plan. Members who have at least five years of credited service are vested.

For more information about vesting, visit our Are You Vested? And What It Means page.

How is my statement estimated monthly payment I recd in the mail almost $1,200 different (less) then when I went to 110 State Street? Doesnt make sense it clearly says this is only a estimate i could see maybe 2 or 3 hundred dollar difference but $1200 is a huge estimate gap…

For account-specific questions about your pension payments, please call our customer service representatives at 866-805-0990, press 2, then follow the prompts. You can also message them using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

I am 62 years of age and I have 31 years and 8 mo0tns of service but I has been discontinued of my teaching role. Do I lose any due to this situation?

This blog is for members and retirees of the New York State and Local Retirement System (NYSLRS), the retirement system for employees of New York State and municipalities outside of New York City.

If you are a member of NYSLRS, please message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

If you are a member of the New York State Teachers’ Retirement System (NYSTRS), you can contact their customer service representatives at https://www.nystrs.org/contact for assistance.

I am currently 55 years old and will have 30 years of service on November 29, 2024 which at that time I will be 57 years of age.

If I choose to retire in 2024, will I receive my full benefits? Some of this is a little confusing so I just want to confirm this before I make my final decision of when I will be notifying my employer of my anticipated retirement date. Thank you in advance.

That depends on your tier and retirement plan. In most cases, Tier 2, 3 and 4 ERS members who are age 55 or older and have 30 or more years of service credit can retire with their full benefit. You can find out more about penalties for early retirement on our website

For account-specific information, you can message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

why do you keep saying 2,3,4 tiers get thier full retirement w 55 and 30 years as stateed above, its 62 years of age according to your statements is full benefits amount you can collect.

Depending on their retirement plan, most Employees’ Retirement System members in Tiers 2, 3, 4 (and some who are in Tier 5) who have 30 or more years of service can retire as early as age 55 with no reduction for early retirement.

For details, visit our About Benefit Reductions page.

If you have questions about your specific situation, please call our customer service representatives at 866-805-0990, press 2, then follow the prompts. You can also message them using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

After 30 years of service you can retire at 55 without penalty if you are a tier 2,3,4 member. Otherwise at 62 you can retire with 5 or more years of service with no penalty. That’s why they say 62 is full retirement age because there is no penalty.

I was hired on 11/29/93 it says i’m in Tier 4, but I thought I should be in Tier 3, how can I check that?

Members who joined the Employees’ Retirement System (ERS) from September 1, 1983 through December 31, 2009 are in Tier 4, though New York State correction officers who joined ERS from July 27, 1976 through December 31, 2009 are in Tier 3.

To look up your tier, sign in to your Retirement Online account and look under ‘My Account Summary.’

For more tier information, please visit our What Tier Are You In? page.

When is the right time for Tier 5 employees to retire? Can we also see infographics and formulas for our tier? We estimate using the info for Tiers 4 and 6, but it would be helpful if there are articles for Tier 5 employees. Thanks.

Most Tier 5 members can retire at age 55, but they will face a pension benefit reduction if the retire before 62.

You can sign in to Retirement Online to estimate your pension benefit based on the information we have on file for you. For general information about your retirement benefits, please check your retirement plan publication.

For account-specific information, please contact our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

Is there any info for Tier 5 employees? The posts and articles always reference Tiers 4 and 6. Thanks

Yes, we have information for Tier 5 members, including our recent blog post about Tier 5 milestones for Employees’ Retirement System members.

I want to know if the Social Security Adjustment (“Beginning at age 62, your pension will be reduced by one-half of the primary Social Security benefit — regardless of whether you are actually collecting a benefit from Social Security”) applies to a Tier 4 NYSLRS retiree. If it does apply, then is that accounted for when I run a Retirement Estimate on my NYSLRS account? Or should I deduct 50% of my estimated SS benefit from the Retirement Estimate?

I will not be retiring for about 20 years but I recently separated from service and do not expect to return, and I want to ensure I am correctly estimating my future Tier 4 pension. Thank you.

For specific questions about your NYSLRS retirement plan, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

I have never heard of the above stated “SS Adjustment”. Could someone clarify if this is the case for a Tier 4 retiree, because I am considering retirement in the next few months. But I am figuring on the estimate I was given for my pension amount and the SS amount I am now receiving. I am collecting a survivor SS benefit, from my work history & my ex-husband’s work history who has recently passed away. I have 25 years of work and I am going to be 67 in January-2023. This would change my whole plan of action if so. I didn’t know this was a thing. Please let me know. Thank you.

If you are in the Article 15 retirement plan, you can read Tier 4 retirement benefit calculation information our website.

For specific questions about your NYSLRS retirement plan, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

I was the person who originally posted the question about the SS adjustment. I sent the secure email form to NYSLRS and they responded saying it does not apply to Tier 4. You may want to email them yourself to be sure.

Here is the information on the ss adjustment and who it impacts.

Your Social Security retirement or

disability benefits can be reduced

The Windfall Elimination Provision can affect how we

calculate your retirement or disability benefit. If you work

for an employer who doesn’t withhold Social Security

taxes from your salary, any retirement or disability

pension you get from that work can reduce your

Social Security benefits. Such an employer may be a

government agency or an employer in another country.

When your benefits can be affected

This provision can affect you if both the following

are true:

• You earn a retirement or disability pension from an

employer who didn’t withhold Social Security taxes.

• You qualify for Social Security retirement or disability

benefits from work in other jobs for which you did

pay taxes.

The Windfall Elimination Provision can apply if one of

the following is true:

• You reached age 62 after 1985.

• You developed a qualifying disability after 1985.

If the latter applies, you must first have become eligible

for a monthly pension based on work where you didn’t

pay Social Security taxes after 1985. This rule applies

even if you’re still working.

This provision also affects Social Security benefits

for people who performed federal service under the

Civil Service Retirement System (CSRS) after 1956.

We won’t reduce your Social Security benefit amount

if you only performed federal service under a system

such as the Federal Employees’ Retirement System

(FERS). Social Security taxes are withheld for workers

under FERS.

How it works

Social Security benefits are intended to replace only

some of a worker’s pre-retirement earnings.

We base your Social Security benefit on your average

monthly earnings adjusted for average wage growth.

We separate your average earnings into three amounts

and multiply the amounts using three factors to compute

your full Primary Insurance Amount (PIA). For example,

for a worker who turns 62 in 2022, the first $1,024

of average monthly earnings is multiplied by 90%;

earnings between $1,024 and $6,172 are multiplied by

32%; and the balance by 15%. The sum of the three

amounts equals the PIA, which is then decreased or

increased depending on whether the worker starts

benefits before or after full retirement age (FRA). This

formula produces the monthly payment amount.

When we apply this formula, the percentage of career

average earnings paid to lower-paid workers is greater

than higher-paid workers. For example, workers age

62 in 2022, with average earnings of $3,000 per month

could receive a benefit at FRA of $1,553 (approximately

51%) of their pre-retirement earnings increased by

applicable cost of living adjustments (COLAs). For a

worker with average earnings of $8,000 per month, the

benefit starting at FRA could be $2,843 (approximately

35%) plus COLAs. However, if either of these workers

start benefits earlier than their FRA, we’ll reduce their

monthly benefit.

Why we use a different formula

Before 1983, people whose primary job wasn’t

covered by Social Security had their Social Security

benefits calculated as if they were long-term, low-wage

workers. They had the advantage of receiving a Social

Security benefit representing a higher percentage of

their earnings. Also they had a pension from a job for

which they didn’t pay Social Security taxes. Congress

passed the Windfall Elimination Provision to remove

that advantage.

Under the provision, we reduce the 90% factor in our

formula and phase it in for workers who reached age 62

or developed a disability between 1986 and 1989. For

people who reach 62 or developed a disability in 1990

or later, we reduce the 90% factor to as little as 40%.

Some exceptions

The Windfall Elimination Provision doesn’t apply if:

• You’re a federal worker first hired after

December 31, 1983.

• You’re an employee of a non-profit organization

who was exempt from Social Security coverage

on December 31,1983. This does not apply if the

non-profit organization waived exemption and did

pay Social Security taxes, but then the waiver was

terminated prior to December 31, 1983.

• Your only pension is for railroad employment.

I keep getting letters from social security waiting to know if, when I retire. They want to take half of my ss check. I write back each time that due to their Windfall Elimination Provision, I CAN NEVER RETIRE!!! I AM 77 WITH 35 YEARS OF SERVICE!!

A customer service representative can explain your NYSLRS retirement benefits to you and provide an estimate of your pension amount.

You can call them at 1-866-805-0990 (or 518-474-7736 in the Albany, NY area), press 2, then follow the prompts. You can also email them using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

For information about your Social Security benefits, please contact the Social Security Administration.

It is almost impossible to contact Social Security. I would have to take a day off work.

Let’s say a newly hired nurse 30 years old ascribed to Tier 6 makes 130,000. Let’s say this nurse decides to work for the state for 30 years and receives 2% raises every year. Compound Interest Formula is A=p(1+r/n)nt A=130,000(1+2%/1)30(1)= 175,220.35 (EST FAS) 175,220.35 x 0.0175= 3,066.356125 x 30= 91,990.68/12=7665.89 (EST monthly pension)

This same nurse is also required to make mandatory contributions to NYS Pension currently at 6% per annum and is subject to change. That’s 130,000 x 0.05=7800.00×30= 234,000

175,220.35 x 0.05 = 8,761.0175×30= 262,830.525

262,830.525+ 234,000= 496,830.525/2= 248,415.2625.

This nurse would have put approximately 248,415.26 into the pension, yet only receive 7665.89 per month. Meanwhile, contribution for Tier 4 stops after 10 years. Basically 32 months into the pension before the nurse reaps the full value of the pension. Whatever raises nurses receive will be absorbed by the mandatory contribution of 6%. This is why many nurses don’t want to work for NYS government because Tier 6 pension plan isn’t fair to Tier 6 members. You all need to replace that 1.66 multiplier by 2% and end mandatory contributions after 15 years of service.

Most Tier 6 members with 30 years of service credit would receive 55 percent of their Final Average Earnings (FAE) if they retire at full retirement age. For information about how Tier 6 benefits are calculated, please see your retirement plan booklet on our Publications page.

For questions about how this may apply in your situation, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

Retirement benefits are established by law. The decision on whether to enact new laws comes from the State Legislature and the Governor. The State Legislature would need to pass a bill and the Governor would need to sign it into law in order to change contribution requirements.

Why should the Legislature change Tier 6? If you are unsatisfied with the compensation and retirement benefit offered, work elsewhere. Tier 4 is a contributing plan; we are fortunate that the Legislature changed article 15 to end contributions at 10 years. Earlier tiers had no contribution amounts. That’s life.

Tier 4 can retire with full benefits at age 55 or later if you have 30 or more credited years of service. Tier 6 has an age 63 requirement for full benefits, regardless of service time.

It was a factor I took into my account in my career decisions.

Some employees can bank and cash in unused sick leave and end up paying little or no health insurance premium in retirement.

Other employees do not have that option. Some employees get lump sum cash payouts for unused sick leave, others do not.

Basically every Tier is different, and there are slight benefit differences within tiers. As stated earlier, if the compensation and retirement benefits are not what you are looking for, there are other employers. No one is forced to serve as a public officer in New York. You can join private industry and have a 401(k), which will not have any defined benefit. It’s your choice.

When the Legislature created Tier 4 a state employee received 3.5 hrs. sick and 3.5 hrs. vacation. The Legislature changed Tier 4. The Legislature also changed Tier 3 and gave these employees the Tier 4 / Article 15 Option. The Legislature also eliminated the 3% contribution after 10 years of service. Tier 6 is significantly different than the other Tiers. It was created by our former Governor Andrew Cuomo. I personally hope our Tier 6 employees lobby the Legislature to modify the language and reduce the ability to retire from 63 back down to 55 years of age. Tier 6 has flaws. The State is demanding that even teachers must work an additional 8 years. We will see how this works as employees in the future enter into their later years in life and realize they are burnt out and have health issues but still are not close to retirement. The next generation will be observing a system of older state employees and a system that isn’t creating job opportunities. No one will remember the man and the elected officials who purposefully and significantly raised the retirement age. I would assume that the State is already having some issues with recruiting younger people. Gov. Cuomo and his influential acquaintances of the “Committee to Save NY” played the game well. Once they received the TARP funds they disbanded and left New York State in a worse mess.

A point of clarification: Tier 6 members in the Article 15 retirement plan can retire as early as age 55. Benefits would be reduced, however, if they retire before age 63.

Could Not have said it better myself !

if your worth so much get out there and get a better job. no one is stopping you

I have 13 years of state service i started in 1992 and left 2004, I will start working for the state again next week, my question is how would i go about buying back my time I was vested and would like to go back to my teir 4 pension and if i buy back those years will i be able to retire at the age of 62 without a penalty i just turned 53. that would give me 25 years at age 65

For information about the status of your account and your options, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

I have 25 years of service and my age is 50. If I leave public service Can I wait until I reach age 62 to collect my pension and avoid any penalties ?

Members in the Article 15 retirement plan who leave public employment can begin receiving their full pension when they reach full retirement age, which is 62 or 63, depending on their tier. You can find out more about penalties for early retirement on our website.

Walk out the door in 5 years with 30years at 55 with NO PENALTY!!! that should be the answer from NYS Retirement, they keep telling people with 30+ and 55 have to stay until 62 or their with be a benifit reduction NOT IF YOU HAVE 30yr and your 55..

In most cases, Tier 2, 3 and 4 ERS members who are age 55 or older and have 30 or more years of service credit can retire with their full benefit. For account-specific information, you can message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

Is there a maximum age beyond 62 (70?) that I am required to begin collecting my pension?

Most retirement plans do not have a mandatory retirement age, but if you have left public employment, there may be no advantage in delaying collection of your pension after you reach full retirement age (62 or 63, depending on your tier).

For account-specific information about how this may apply in your situation, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

Is there a maximum benefit per tier? If so, what is the maximum benefit for tiers 3, 4, 5, & 6? What is it based on?

For details about your retirement benefit calculation, please read your retirement plan booklet on our Publications page or email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

I applied for Tier Reinstatement back in 2019 (was an employee in the late 80’s/early 90’s). I have been waiting for reinstatement progress for over 2 years. I have called/written/and have been scolding for calling every six months! How can I get my previous time counted? I technically should qualify for vesting in a few months. I need to pay back and re-establish before something happens and eligibility changes! Should I seek out my own employment records from my previous employer and submit? If so, what exactly do I need to provide? I would rather not have to bother people digging documents out of archives from 30 years ago more than once!! Please help! Thanks.

We’re sorry for the trouble you’re having. Your message is important to us and we have sent you a private message in response.

I have also been waiting since October 2020. I was an employee in the early 90s and would like to move forward with Tier Reinstatement. I’ve called and have had a “consultation” and been told that it takes 24 months before I can even ask questions. It is obvious that the information has been located as I have received mail erroneously in my maiden name. A friend, in another union, just began her job with the state and got her reinstatement within two months. Why does it take so long? Can someone help me get this to move forward? Thank you!

Your message is important to us, and we have sent you a private message in response.

I have been trying to get my prior service credit transferred to NYSTeachers retirement. It shows it was requested but nothing has been done yet. I was hoping to retire this year but need this done prior to this. What can I do?

The NYSLRS social media team does not have access to your account information, but we’d like to help.

For assistance, please call our customer service representatives at 1-866-805-0990 (or 518-474-7736 in the Albany, NY area), press 2, then follow the prompts. You can also email them using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

I am currently Tier 6, waiting to be reinstated to Tier 4 from previous employment over the years going all the way back to 1993. I submitted the proper Reinstatement paperwork in 2019. I’ve been paying in to Tier 6 while I wait for reinstatement to Tier 4. I will also owe about $5k to get back in to Tier 4. In the meantime, I’ve paid almost $3k into Tier 6. Will I get that money back? Can the money I’ve put into Tier 6 be applied to what I’ll have to pay in to Tier 4?

Also, I’ve written emails, letters, and made phone calls to see why I haven’t been reinstated yet. No response from anyone. It’s been over two years, and I’m eligible to retire this time next year. I can’t use the online calculator to calculate my pension because I’m in your system as Tier 6. How long does it typically take to hear back?

We apologize for trouble you are having. Your message is important to us and we have sent you a private message in response.

I am in the same boat. I am waiting on service credit and tier reinstatement. I submitted my paperwork over 3 years ago. I have also called, emailed numerous times and can’t get an answer

This is so frustrating.

We apologize for the delay. Your message is important to us and we have sent you a private message in response.

Hi, i have the same issue. I applied for Tier 4 reinstatement back in July 2019 and have not heard a thing. I call and get hung up on saying high call volume. I tried emailing and got a canned response. I didn’t think it took 3 years to find this out. Is there any way I can get an answer?

Your message is important to us and we have sent you a private message in response.

Hello. Can someone please explain how to figure out credit service for working part time? I work 3 days a week and 4 hour shifts per day. How long will it take me to earn a full credit service year?

I currently have 19.48 credit service years. How long will it take to hit the 20 year mark with this work schedule?

If you work part-time, your service credit is prorated. For more information about how part-time service credit is calculated, please read our blog post How Full-Time and Part-Time Service Credit Works. If you work for a school district, please read the blog post How School Employees Earn NYSLRS Service Credit. For information about how this may apply in your particular situation, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

Ok you keep saying your highest 3 years. Correct me if I’m wrong. Highest 3 years not exceeding 10% of the next lowest ?

Final average earnings (FAE) is the average of a member’s three (five for Tier 6) highest consecutive years of earnings, subject to limitations. Those limitations vary by tier and retirement plan. You can find more information on our Final Average Earnings page.

For account-specific questions, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

The If Vested and Off Payroll chart is very misleading and I don’t understand why NYSLRS keeps using this graph. Only under extraordinary circumstances would someone retire at age 55 with only 19 years of service; most would simply wait until they had 20 years of service to increase the % calculation. In the future can you please repost the graph showing a more realistic scenario (i.e., 55 and 20 years of service vs. 62 with the additional years of service a person would have assuming they chose not to retire at 55 and instead kept working on to 62)?

Thank you

Thank you for your input.

The If vested and off payroll chart early vs full retirement chart also does not consider wage increase from age 55 to age 62, wouldn’t the FAE be more at age 62 than at age 55? The chart should be revised and/or clarify assumptions

Thank you for your input.

If you buy back credit service from a prior tier would that make you eligible for that tier?

Your tier is based on your date of membership. Purchasing credit for previous service will not change your tier if you didn’t join a public retirement system while working for that employer.

For account-specific information, you can email our customer service representatives using the secure email form on our website (http://www.emailNYSLRS.com). One of them will review your account and respond to your questions. Filling out the secure form allows them to safely contact you about your personal account information.

I want to submit a question, however, I don’t know my Registration #. How do I get that?

Your message is important to us and we have sent you a private message in response.

Good Afternoon –

I realize that it may be hard to answer some questions, because everyone’s situation is different. I Have looked at questions and info here, and I just wanted to paraphrase…because I am still somewhat unclear: I will use my case as an example:

I am a tier 4 member, and at age 59 I will have just over 25 years of service. If I opted to retire and start collecting pension at that time, my retirement benefit will be permanently reduced by 15%. If I opted to wait until age 60 to start collecting, will the penalty now go down to 12%? Or if I waited until age 61, the penalty would drop to 6%?

In other words, does the penalty kick in from the day you leave service, or from your age when you start collecting the pension?

Thank you!

The penalty for early retirement only becomes effective when you start collecting your pension. For example, if you leave public employment at age 59 but don’t apply to receive benefits until you turn 60, the age 60 reduction would apply. However, leaving public payroll before you are eligible to retire may affect your eligibility for certain death benefits and health benefits.

If you are considering leaving the public payroll before you are ready to retire, we suggest you speak with a customer service representative to find out how it would affect your pension benefits. You can call them at 1-866-805-0990 (or 518-474-7736 in the Albany, NY area), press 2, then follow the prompts. You can also email our them using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

You may also wish to speak to your health benefits administrator to find out how going off payroll would affect any post-retirement health benefits you may be entitled to.

Can someone give an example of their monthly take-home pension? How much for a tier 4 with 30 years at age 59?

Most members can use the benefit calculator in Retirement Online to estimate their pensions based on information we have on file for them. Sign in to your account, go to the My Account Summary area of your Account Homepage and click the “Estimate my Pension Benefit” button.

If you need help with Retirement Online, please contact the NYSLRS Call Center at 1-866-805-0990 (or 518-474-7736 in the Albany, New York area). Press 2 and follow the prompts. The Call Center is available Monday through Friday from 7:30 am – 5:00 pm.

I understand the FAS can represent the best 3 consecutive years. I had a drop in salary after being laid off with one State employer, but was hired by another within the same year (with a two month break in service). I would like to use the higher salary in my FAS, but not sure how the 3 year rule is applied..is this fiscal year, calendar year or any 36 month consecutive period? Can I use the period that had a break?

To find out how the FAS would be calculated in your specific circumstances, please call our customer service representatives at 1-866-805-0990 (or 518-474-7736 in the Albany, NY area), press 2, then follow the prompts. You can also email them using our secure email form. Filling out the secure form allows our representatives to safely contact you about your personal account information.

Is BERS included in this

This information applies to members of the New York State and Local Retirement System (NYSLRS) who are in Tiers 3 and 4 and covered under the Article 15 retirement plan.

If you are in another NYSLRS retirement plan, you can find information about your benefits in your retirement plan booklet or by contacting our customer service representatives using our secure email form. If you are a member of another retirement system, please contact them.

Can you retire at age 55 with 30 years of service with out reduction in your pension?

Yes, Tier 3 and 4 Employees’ Retirement System members who are in the Article 15 retirement plan and have 30 years of service credit can retire at age 55 without penalty.

For account-specific information, please email our customer service representatives using the secure email form on our website (http://www.emailNYSLRS.com). One of them will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

THE CITY OF ALBANY HAS SUCKED THE LIFE OUT OF THE 911 DISPATCHERS THAT ARE LEFT (14) OPENINGS, I CANT TAKE IT MUCH LONGER WORKING 56 AND 64 HOUR WORK WEEKS 24/7, I AM 52 AND HAVE 32.4 YEARS OF SERVICE…IS IT REALLY WORTH WORKING THIS MUCH FOR ANOTHER WHAT $350 MORE A MONTH WHEN I FLY OUT THE DOOR AT 55?

If you chose to leave public employment, you would be able to apply for a vested retirement benefit as early as age 55. However, leaving public payroll before you are eligible to retire may affect your eligibility for certain death benefits and health benefits.

If you are considering leaving public payroll before age 55, we suggest you email our customer service representatives using the secure email form on our website to ask how it would affect your pension benefits. A representative will contact you to address your questions. Filling out the secure form allows them to safely contact you about your personal account information.

You may also wish to speak to your health benefits administrator to find out how going off payroll would affect any post-retirement health benefits you may be entitled to.

I’m with you . I worked for CNYDDSO as a nurse . And there are so many openings it was putting my license on the line so I retired Sept 30th of this year at age 60 . Its NOT worth me staying til 62 . And if you think about it your really not loosing money . No state tax comes out , and no union dues come out. No more wear and tear on my car and saving on gas . So NOT waiting 2 yrs was a no brainer to me

your so correct Maam- staying the extra year or two for 250 more a month is not worth it at all, like you said no union dues no worrying about getting holidays off after 33 years, fighting to get mothers or fathers day off because the 20 somethings cant bother to come to work. I’m so done with this.

Yes you can as long as you have 30 Years or more of Credited service

Tier 3 and 4 Employees’ Retirement System members who are in the Article 15 retirement plan and have 30 years of service credit can retire at age 55 without penalty.

I am Tier 4 and by age 56 have 26 years with nys. Can I retire?

Most Tier 4 members can retire as early as age 55, however, those who retire before age 62 with less than 30 years of service credit may face a permanent benefit reduction. You can find information about benefit reductions for early retirement on our website.

Most Tier 2 – 6 members can use Retirement Online to create a NYSLRS pension estimate based on the salary and service information we have on file for you. You can enter different retirement dates to see how your choices affect your potential benefit.

For account-specific information, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

If I retire at 57 but do not collect any pension benefits until after I turn 62, could I begin collecting my pension without the age penalty at 62 going forward? How could this be accomplished? Would I resign and then not officially retire for 5 years?

If you leave public service before full retirement age (62 or 63, depending on your tier), you can apply for and receive a pension without penalty when you reach retirement age.

However, leaving public payroll before retiring may affect your eligibility for certain death benefits and health benefits.

We suggest you email our customer service representatives using the secure email form on our website to ask how it would affect your pension benefits. Filling out the secure form allows them to safely contact you about your personal account information.

You may also wish to speak to your health benefits administrator to find out how going off payroll would affect any post-retirement health benefits you may be entitled to.

I’m tier 4 with 26 years of service . In four years I’ll be 52 with 30 years of service . Can I retire then ?

Members in regular retirement plans must be at least 55 years old to begin receiving a NYSLRS service retirement benefit.

For account-specific information, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

I resigned from my employer in early 2019 with 18 years of service and at age 47. I understand that I cannot begin to receive benefits until age 55. I believe my pension benefit will be calculated as 1.66% * final average salary * years of service. I believe it will further be reduced due to my early resignation. My question is, is my benefit reduced by the 27% indicated for retirees at 55 years of age? Or is it reduced by more than 27% due to my resignation at age 47?

Most members in regular retirement plans who retire at age 55 will face a pension reduction for early retirement. The reduction percentage depends on your retirement plan and tier. There is no additional reduction for leaving public employment before age 55.

For information about your specific circumstances, please call our customer service representatives at 1-866-805-0990 (or 518-474-7736 in the Albany, NY area), press 2, then follow the prompts. You can also email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

I have 20 years in with 3 consecutive highest salary being the last 3 years(years 18,19,20). What if I went and took a job making less for the remaining 10 years. Will my final average salary be calculated on my 3 highest consecutive salary years (essentially year 18,19,20)?

Yes, your final average salary will be calculated on the three consecutive years when your earnings were highest, regardless of when they happen in your career.

I have 22 years in and I’m in Tier 4 with physical taxing and I’ll be 42. I would to like to retire now. Will I be able to?

As a Tier 4 member, unless you are in a special plan that allows retirement after 20 or 25 years regardless of age, you must be at least 55 years old to retire and collect a NYSLRS service retirement benefit.

If you are permanently disabled and cannot perform your duties because of a physical or mental condition, you may be eligible for a disability retirement benefit.

For account-specific questions, please email our customer service representatives using the secure email form on our website (http://www.emailNYSLRS.com). One of them will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

i am a tier 4 member with 20 yrs of service. Although I know there are penalties and I can not collect my benefit until I am at least 55 can I “retire” before 55? Not sure how all this works. Hope this isn’t a dumb question.

If you are a vested member of a regular retirement plan, and you leave public employment before age 55, you can begin collecting your pension once you turn 55.

You should be aware that if you leave public employment before you are old enough to receive a pension, you may lose certain retiree benefits, such as death benefits. You should contact our customer service representatives at 1-866-805-0990 (or 518-474-7736 in the Albany, NY area) for more information. You should also speak to your health benefits administrator to find out how health benefits would be affected.

Please note: Your pension is not automatic; you must apply for retirement to receive a benefit. You can file for retirement using Retirement Online. For more information, please read our booklet What if I Leave Public Employment?

I’m tier 4…I started working at 22. I’ll have 20 years when I’m 52. If I resign from my job at 52 (30 years) can I wait three years to then officially retire? and not have any penalties?

A Tier 4 member with 30 years of service credit can receive a NYSLRS retirement benefits at 55 without penalty, even if they left public employment before they were eligible to retire.

However, leaving public service before retirement may affect other benefits. You may wish to read our booklet What if I Leave Public Employment? for more information, and email us using the secure form on our website if you have questions. You may also wish to speak to your health benefits administrator to find out how leaving employment before retirement might affect your health benefits.

Im a tier 4 with 18 years in the pension system. I have been thinking about retiring at 20 years. I will be 42 years old then. Can I do that? If so I can’t start to collect until I turn 55?

With ten years of service, you’ll be eligible for a NYSLRS pension even if you leave public service before retirement age. However, most NYSLRS members must be at least 55 years old to begin receiving a pension.

For account-specific information, please email our customer service representatives using the secure form on our website (http://www.emailNYSLRS.com). One of our representatives will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

I have asked this question several times at NYSERS workshops and no one seems to know anything about it. I am referring to the Windfall Elimination Provision of Social Security. I am told that when I retire and start collecting my pension, due to the fact that the Williamsville district does not pay enough , therefore not enough ss was taken out of my paychecks, they will reduce my social security by almost half. They consider my pension a windfall. Which is crazy because it will not be anywhere near what I am making and taking that much ss away from me will put me in the poverty level where I will have to go on medicaid. How is this helping? I am in my 33rd year and am afraid to retire and put myself in this position. Social security sends me a form several times a year asking me when I will retire. I reply NEVER due to the WEP. This form also lists the amounts of salary for each year as a parameter, and I fall short each year by a couple thousand dollars. Right now I am collecting my regular pay and my full social security. Would it not have been better for them to reduce my ss while I was working and give me my full amount when I retire? Anyone else out there in this predicament?

Your question and circumstances would be better addressed by the Social Security Administration. You can call them at 1-800-772-1213.

Social Security will not budge on this, Just want to let other school employees know what they are facing when they retire. There are parameters that must be met and many school employees do not meet them. So check before you retire.

I am 58 with 19 years of service to date. I was recently told by our school representative, that as a Tier 4 member, as long as I wait until age 62 to retire, at which time I will have 23 credit years of service, there would be no penalty and I would receive full benefits the same as if I had 30 years, ie 60% of my FAS. Based on own my interpretation, I thought I would be entitled to only 23 x 2%, or 46% of my FAS. Although I am fairly certain this is correct, I just want to clarify, as I only read throughout the benefits information package, “At age 62, you can retire with your full benefits”, which doesn’t fully explain this.

A Tier 3 or 4 member who retires at age 62 with 23 years of service credit will receive 2 percent of their final average salary for each year of service (for a total of 46 percent of FAS). “Full benefits” means there would be no penalty for early retirement.

Most members can use the pension benefit calculator on our website to estimate your pension based on information you enter. You can enter different retirement dates, final average salaries and service credit totals to compare different outcomes.

I’m in a 25 year plan. Would there be an advantage to retiring with 21 years service at 60 years of age?

Most members can use the calculator in Retirement Online to estimate their NYSLRS pension based on the salary and service information we have on file for them. You can enter different retirement dates, final average earnings and service credit totals to compare retirement outcomes.

For account-specific information questions, please email our customer service representatives using our secure email form. One of our account representatives will be able to answer your questions. Filling out the secure form allows them to safely contact you about your personal account information.

Just wondering how the FAS three year window is determined? Is it based on a calendar year, anniversary date, etc?

Final Average Salary (FAS) is the average of the highest three (five for Tier 6) consecutive years of earnings. The years used in calculating your FAS are usually your last three years of employment, and they do not need to correspond to the calendar year, the State fiscal year or hiring date.

For clarification Lorna Moffre, it is your 36 highest consecutive months.

I’m trying to figure out if taking 41j for my sick time is better than taking a buy out. I have 265 sick days banked and 35 years of service. Is there a formula that calculates what your pension would be with and without 41j service credit? I realize a lot of it can depend on how long you live, but if you picked an arbitrary number of years like 15 years someone should be able to calculate the difference. This is simply an investment question.

You can find out how unused, unpaid sick leave may affect your pension calculation by reading our blog post titled What Unused Sick Leave Might Mean For You at Retirement. Once you know approximately how much service your sick leave would provide, you can use our online calculator to estimate your pension with and without the additional service.

For account-specific information, please email our customer service representatives using the secure form on our website (http://www.emailNYSLRS.com). One of our representatives will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

When is the earliest I can retire with no age penalty after I turn 62? Is it the day I turn 62 or is there a waiting period?

If you are in a retirement plan that allows for retirement with no reduction at age 62, there’s no waiting period after you turn 62.

We recommend that you contact our customer service representatives to ask any account-specific questions you may have before you choose a date. You can email them using the secure email form on our website (http://www.emailNYSLRS.com).

You may also find our publication, How Do I Prepare to Retire, helpful. It’s available at http://www.osc.state.ny.us/retire/publications/vo1709.php.

If i have 21.5 years of service (tier 4) and I just turned 58, If I decide to leave public service (retire) from what I have been reading(not sure I am interpreting correctly) my FAS X .02 X 21.5 years will be penalized by 18%. Will I be collecting my pension immediately upon leaving public service at the 18% reduction? Or will I be penalized further? What is confusing to me is, age is a variable. In other words, If a person who is five years older starts working same day I do, and if we retire same day 21.5 years of service. The person who has same amount of time in service but is older will make more money because he was not penalized. It is very hard to understand. Can anyone shed light on this. I would greatly appreciate. Thank you.

You are correct, for most members, age is a factor in retirement benefit calculations.

If you are a Tier 4 member with less than 30 years of service, and you retire (collect your pension) before age 62, your pension will be permanently reduced. Whether you collect your pension immediately upon leaving public service is up to you. You can delay taking your pension and continue working till you turn 62 and receive a full benefit.

Tier 4 members can use our Benefit Projector Calculator to estimate what your benefit would be at different retirement dates. You may also be interested in our publication What If I Leave Public Employment?

Just curious as to how much my benefit would be reduced if I left state service at age 54 with 30 years state service? I can’t seem to find any information about leaving before 55 with 30 years in.

Most NYSLRS members must be at least 55 to collect a pension. If you are considering leaving payroll before you retire, you should contact our customer service representatives to discuss how that would affect your NYSLRS benefits. We would also recommend that you speak to your health benefits administrator to find out how any post-retirement health benefits would be affected.

For account-specific information, please email our customer service representatives using the secure form on our website (http://www.emailNYSLRS.com). One of our representatives will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information. You may also wish to read our publication What If I Leave Public Employment?

I would like to retire at 55, with less than 30 service, but not collect benefits until I am 62. Do I need to wait until 62 to fill out my paperwork or can I fill it out at 55 and defer benefits? My concern is for my wife if I die between 55 and 62. I want to make sure she continues to receive my retirement check if I die first. But if I die between 55 and 62 and haven’t filled out retirement paperwork then I assume she would loose out on the ability to collect my retirement benefits.

You cannot submit an application for retirement benefits more than 90 days before your retirement date.

If you are considering going off the payroll and waiting to collect your pension, you should speak to a customer service representative about how that would affect your benefits. For example, depending on your retirement plan, you may need to retire (collect your pension) within a certain amount of time after leaving the payroll to maintain eligibility for certain death benefits.

You can email our customer service representatives using our secure email form (http://www.emailNYSLRS.com), and one of our representatives will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

You may also want to speak to your employer health benefits administrator to find out how leaving payroll and waiting to collect your pension would affect your health benefits.

Do you receive credit for working more than 40 years under tier 4 ?

Assuming you are in the regular ERS Article 15 retirement plan, for each year of service beyond 30 years, you’ll receive 1.5 percent of your final average salary (FAS) with no maximum percentage. For the first 30 years, you’d receive 60 percent of your FAS.

You can find information about your pension benefit in your plan publication.

For information about your specific situation, please email our customer service representatives using our secure email form. One of our representatives will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

I am a tier 4 with 22 years can I retire now

Under most Tier 4 retirement plans, you must be 62 years old (or have 30 years of service credit) to retire with your full benefit. However, you may retire as early as age 55 with a reduction for early retirement. The specific amount of the reduction varies by age.

For information about your particular situation, please email our customer service representatives using our secure email form. One of our representatives will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

This may sound like a strange question, but is there a MANDATORY age for retirement under Tier 4? My municipality is forcing us to retire upon our 65th birthday. Is there any law governing that limitation?

Certain retirement plans may have a mandatory retirement age, but unfortunately, the NYSLRS Social Media Team does not have access to your account information to determine if they apply to you.

To get the account specific information you need, we recommend emailing our customer service representatives using our secure email form. One of our representatives will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

if I retire early and work again not in a public sector, how will my wages affect my pension?

Generally, unless you retire under a disability retirement, earnings are unlimited for retirees if they are self-employed; work for a private employer; work for another state or its political subdivisions; or work for the federal government.

For more information, we suggest reading our Life Changes: What If I Work After Retirement? publication.

this is very confusing to me. I am a Tier 4 member. It is my understanding that as a Tier 4 you can retire at age 55 with 30 years of service and receive 60% of your final highest average salary. Why is it being explained that full retirement is at age 62? That is simply not accurate. Please explain. Thank you

You are correct that Tier 4 members in the Employees Retirement System with 30 years of service credit can retire at age 55 without a benefit reduction. And, yes; with 30 years of service, your calculation would be 60 percent of your FAS.

However, members retiring before age 62 without 30 years of service credit would see a significant reduction in their benefits as shown in the graphic.

I will be 59 on October 5th and will have 30 years of service in September. Will I qualify for my full benefit at that time? I would love to retire at the end of October. Which day would be best to go? Thank you!

If you are an ERS member in Tier 3 or 4 and over age 55, you will be eligible for your full retirement benefit once you reach 30 years of service.

Which day you retire is up to you, but if you are thinking of retiring this year, you may want to contact our Customer Service Representatives to request a benefit projection or discuss your options.

To get the account-specific information you need, please email our customer service representatives using our secure email form (http://www.emailNYSLRS.com), and one of our representatives will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

“the formula for the first 20 years is FAS × 1.66% × years of service; between 20 and 30 years”

I understood that when you reach 20 years of service, all of your years are then calculated at 2.00%?

You are right. When you reach 20 years of service, the first 20 years of service are calculated at 2 percent instead of 1.66 percent. We apologize for the confusion, and we have updated the blog to make that clear. Thank you.

Is there any chance of a State financial incentive and or County incentive to induce state and County workers to retire and reduce payroll? Word is the State is offering a buyout. Is this true?

At this time, we’re not aware of any discussions about statewide retirement incentives. The New York State Legislature (not NYSLRS) occasionally enacts these retirement incentive programs, which are approved by both houses and signed into law by the Governor. The Retirement System administers programs that are signed into law. We’ll notify your employer if the Legislature makes a State incentive program available.

Non-State employers (such as Counties) may choose to offer incentives to their employees, however, it’s important to note that these individual employer incentives will not affect a member’s NYSLRS pension benefits.

If I am 55 and have 30 years of service, is this the same benefit that I would receive at 62?

That depends on your situation. If you are a Tier 3 or 4 member with 30 years of service, you can retire at 55 with no reduction to your benefits. But if you continue to work till 62, you will accrue additional service credit, which would increase your benefit.

However, if you were to leave public service at 55, your benefit would not increase if you waited until 62 to apply for retirement.

Our online retirement benefit calculator allows most members to estimate their benefit with different retirement dates, final average salaries and service credit totals. By changing each variable, you can see the impact it may have on your benefit.

can I retire with 22 years of service at age 62 in a tier 4 and still get my full retirement.

There is generally no benefit reduction for Tier 4 members beginning at age 62.

You may be interested in reading our blog post, Member Milestones for ERS Tier 3 and 4.

You can use Retirement Online to create a pension estimate based on the salary and service information we have on file for you. Sign in to Retirement Online. From your Account Homepage, go to the ‘My Account Summary’ section and click the “Estimate my Pension Benefit” button.

You can:

• Enter different retirement dates and beneficiaries to see how they affect your potential benefit;

• Adjust your earnings or service credit if you anticipate an increase in earnings or plan to purchase past service; and

Save or print your estimate.

Is a retirement benefits the same as receiving paycheck every other week? (such as a payday)

Pension benefits are paid on a monthly basis, at the end of every month. For example, we send out May’s payment at the end of May.

If your benefit is paid by direct deposit, you will have access to it on the last business day of each month. If your benefit is paid by check, we will mail it on the second-to-last business day of each month.

For specific pension payment dates, check out our Pension Payment Calendar page.

I started working for the state 2008 can I retire after 10 years

If you’re an ERS member, starting in 2008 would place you Tier 4. Tier 4 members only need five full-time years of service credit to earn a retirement benefit.

However, there is also an age requirement: You must be at least 55 years old to qualify for a retirement benefit. And, to receive your full benefit, you must be 62 years old at retirement. If you retire before 62 with less than 30 years of service, you will receive a reduced benefit.

For account-specific information, we recommend emailing our customer service representatives using our secure email form (see link below). One of our representatives will review your account to address your questions. Filling out the secure form allows us to safely contact you about your personal account information. Please allow five to seven business days for a response.

http://www.emailNYSLRS.com

If I leave State service before 55 when I do file on my 55th birthday will my dad still be based on leaving with 30 days vac?

Actually, a recent blog post tackles filing for retirement.

If you are a Tier 3, 4, 5, or ERS Tier 6 member, you are eligible for a benefit on your 55th birthday. You can submit your retirement application 15 to 90 days before you turn 55. If you are off payroll and you submit your application on or after your 55th birthday, your application will be effective immediately upon filing with this office.

Assuming you’re a Tier 3 or 4 ERS member, your lump-sum vacation payout will still count towards your final average salary (FAS), even if you go off state payroll, as long as your FAS is based on your last three years of service. Learn more in the ERS Tier 3 and 4 retirement plan book.

For more detailed, account-specific information, please email our customer service representatives using our secure email form. One of our representatives will review your account to address your questions. Filling out the secure form allows us to safely contact you about your personal account information. Please allow five to seven business days for a response.

In the above reply, you say the “yiur FAS is based on last three years of service” isn’t it your highest three years? At any point you’ve been in the system? As mentioned in a few posts above?

Yes, Final Average Salary (FAS) is the average of the highest three (five for Tier 6) consecutive years of earnings. Usually your FAS is based on the years right before retirement, but they can come anytime in your career.

According to #3 above, for Tier 3 and 4 members, “the formula for the first 20 years is FAS × 1.66% × years of service; between 20 and 30 years, the formula becomes FAS × 2.00% × years of service”. How to understand the “first 20 years” here? If an employee has 30 years of service, the formula is “(FAS x 1.66% x 20) + (FAS x 2% x10)” OR “FAS x 2% x 30”? Please clarify. Thanks.

In this case, if a member has less than 20 years of service, the formula is:

FAS x 1.66% x total years of service.

If a member has 20 to 30 years of service, the formula is:

FAS x 2% x total years of service.

If a member has 30 or more years of service, the formula is:

FAS x 2% x 30 PLUS FAS x 1.5% X each year beyond 30 years.

Hello. It the last sentence accurate? The Comptroller’s website says: •For each year of credited service beyond 30 years, you will receive 1.5 percent of your FAS.

Example shown:

35,000 × 2% × 30 years = $21,000 per year

plus

$35,000 × 1.5% × 1 year = $525 per year

= $21,525 per year or

$1,794 per month

ERS Tier 3 and 4 members who have reached 30 years of service receive 1.5 percent of their final average salary (FAS) for each additional year of service. So a member with 31 years would receive a retirement benefit equal to 61.5 percent of their FAS.

Hello,

I had same question as previous commenter RT did when reading your April 5, 2017 comment: That comment says:

“If a member has 30 or more years of service, the formula is:

FAS x 2% x total years of service PLUS FAS x 1.5% X each year beyond 30 years.”

But what I believe it should say is:

“If a member has 30 or more years of service, the formula is:

FAS x 2% x 30 YEARS of service PLUS FAS x 1.5% X each year beyond 30 years.”

Your follow up comment on May 4th saying that someone with 31 years of service would have 61.5 percent of FAS does appear to be the correct info, but that is different than than the first info I quoted above.

Thank you for pointing this out. The blog post has been updated.

I just had a change in employment which raises my salary more than 10%. I am just short of 62, with over 30 years service credit. Do I now have to work 5 more years to benefit from the increase in terms of my FAS?

Limits to final average salary (FAS) are based on retirement plan and tier. You can find information about how your FAS is calculated on our website.

Most Tier 1-4 members can use our Benefit Projector Calculator to estimate their retirement benefit. The calculator allows you to enter different retirement dates and FAS to compare potential benefits.

If you are tier 3 or 4, sadly, I’m afraid so….

At age 55 I will have 35 yrs of service. I understand there will NOT be a penalty for retiring at this age, other people which have retired at ages 58 or 60 indicated they have been informed if they were to continue to work another year or two, they gain an additional $500 to $800 dollars more a year and have been told by the person advising them it isn’t worth the additional years working for that amount of money. Is this truly the case? The additional years only adds maybe $500? If so, then I feel retiring at 55 is the answer since I could find a part time job and make that amount of money and enjoy more down time.

Benefits and reductions vary significantly by tier and plan. We have two ways to help you compare your specific pension benefits at age 55 versus 58 or 60:

I have 30 yrs of service credit and will be 54 yoa in June.

Will I be penalized if I quite my job and start collecting my retirement next year when I turn 55?

If you leave public service, you may apply for a retirement benefit at age 55. However, certain benefits could be affected if you don’t retire directly from the public payroll.

Unfortunately, the NYSLRS Social Media team doesn’t have access to members’ account information. To get the account-specific information you need, please email our customer service representatives using our secure email form (http://www.emailNYSLRS.com). One of our representatives will review your account and get back to you. Filling out the secure form allows us to safely contact you about your personal account information. Please allow five to seven business days for a response.

In addition, you may want to speak with New York State Civil Service or your employer’s health insurance benefit administrator for information about your health insurance benefits. (Please note: NYSLRS does not administer health insurance benefits for its members or retirees). If you participate in the New York State Deferred Compensation plan, you may also wish to speak with one of their representatives.

and yet sometimes if the organization wants you to retire early they make it difficult to work longer and they do – do it and it’s not up to the employee Sad but true- saw it happen too many times

very, very true!!