For some NYSLRS members, your retirement age matters when it comes to receiving your NYSLRS retirement benefits.

Your pension will be based largely on your years of service and final average earnings, but your age at retirement is also a factor. How age plays into the equation depends on your tier and retirement plan.

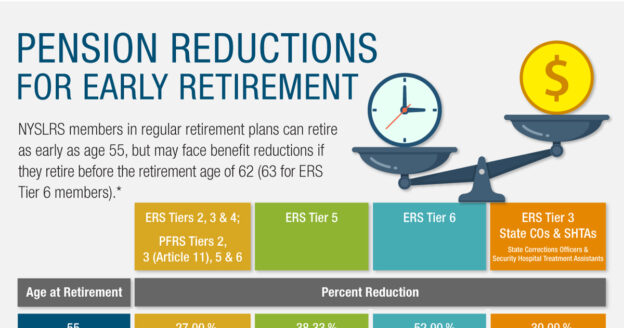

Members in regular retirement plans can retire as early as age 55, but they may face significant pension reductions if they retire before their full retirement age. The full retirement age for members in most tiers is 62, and it’s 63 for Employees’ Retirement System (ERS) Tier 6 members and for Police and Fire Retirement System (PFRS) Tier 6 members who leave public employment before retirement age, but have enough service to receive a pension. If you joined NYSLRS on or after April 1, 2012, you are in Tier 6.

Benefit reductions are prorated by month. The closer you are to your full retirement age when you retire, the less the reduction will be. Here are some examples of how that would work.

- ERS Tiers 2, 3 and 4, PFRS Tiers 2, 3 (Article 11), 5 and 6: If you retire at age 58 1/2, your pension will be permanently reduced by 16.5 percent.

- ERS Tier 5: If you retire at age 58 1/2, your pension will be permanently reduced by 20.83 percent.

- ERS Tier 6: If you retire at age 58 1/2, your pension will be permanently reduced by 29.5 percent.

Once you retire with a reduced benefit, the reduction is permanent — it does not end when you reach retirement age.

Retirement Age Exceptions

Tier 1 members can retire at 55 without a benefit reduction. Benefit reductions don’t apply to ERS Tier 2, 3 or 4 members if they retire with 30 years of service. Tier 5 Uniformed Court Officers and Peace Officers employed by the Unified Court System can also retire between 55 and 62 without penalty if they have 30 years of service.

More Information

Understanding how age affects your NYSLRS benefits is crucial to retirement planning. To learn more, please review your retirement plan booklet on our Publications page.

You can check your service credit total and estimate your pension using Retirement Online. Most members can use our online pension calculator to create an estimate based on the salary and service information NYSLRS has on file for them. You can enter different retirement dates to see how your choices would affect your potential benefit.

Im in Tier 2 Police ad Fire and I will have 20 years at the age of 54 if I retire at 54 what percentage of my pension will I receive?

Your pension calculation and retirement age depend on what retirement plan you are in. To find your specific retirement plan details, please visit our Find Your NYSLRS Retirement Plan Publication page.

If you still need help, please message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

Can I reverse my retirement decision? I retired at 60. Can I pay that money back and retire later?

Please contact our customer service representatives to discuss your options. Call 1-866-805-0990 (or 518-474-7736 in the Albany, NY area), press 2, then follow the prompts. You can also email them using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information. One of our account representatives will be able to answer your questions.

NYSLRS why are you directing them to call? I’d like to know the answer. I’d like to know different scenarios or possibilities regarding retirement and changing your mind as a tier 4 member

Retirees who are considering suspending their pension and returning to NYSLRS membership should speak to a customer service representative to discuss the specifics of their situation.

If you are not yet retired, you can use the benefit calculator in Retirement Online to estimate your pension based on information we have on file for you. Sign in to your account, go to the My Account Summary area of your Account Homepage and click the “Estimate my Pension Benefit” button. If you don’t already have an account, go to the Sign In page and click the “Sign Up” link under the Customer Sign In button.

If you need help with Retirement Online, please call our customer service representatives at 1-866-805-0990 (or 518-474-7736 in the Albany, NY area), press 2, then follow the prompts.

I’m sorry. You guuys are doing a poor job of answering questions. Of course if it’s something specific people should call the representative. However, you should be able to answer “is it possible to return the funds and re-retire later. Why not give us a quote from the tier books that answer the question?

Same for the individual regarding military. I’ve asked this question before and had been given the same answer.

You don’t answer the questions. If it has to do with tier then say for example” in this tier you can pay back the funds and go back to work to continue building your pension: or maybe say ” by suspending your pension this such and such could happen.”

Entry into Tier 1 ended in July of 1973, right? I think it would be wise to remove the “no penalty for retiring at age 55” exception statement for that tier. An employee would have had to join at the tender age of six to not have reached 55 yet. Not only is it extraneous information, but serves to highlight how worker appreciation has gotten worse, not better, over the last 50 years reflected in the benefits package the State offers.

Thank you for your feedback.

if I’m a national guard member and called back to duty but the municipality still supplements my salary is my time in the NYSPFRS affected?

Example if I was called away for a year:

Military salary $50,000

FF supplement salary $20,000

————————————–

TOTAL FULL FF salary when not called in $70,000

So I’m still receiving my full salary for a year but I’m serving and being paid by military and supplemented by municipality but is my service time in NYS pension affected?

There are different sections of the law that allow credit for military service.

For questions specific to your circumstances, please contact our customer service representatives. Call 1-866-805-0990 (518-474-7736 in the Albany, New York area), press 2, then follow the prompts. You can also or email them using the secure form on our website (http://www.emailNYSLRS.com). Filling out the secure form allows us to safely contact you about your personal account information.

Was their ever talk on lifting the requirement of having 30 years to retire at 55? Why was that imposed?

Depending on your retirement plan, if you have 30 years of service credit, you can retire at age 55 without a reduction, but you are not required to have 30 years of service in order to retire at age 55.

For account-specific information, please email our customer service representatives using our secure email form. Filling out the secure email form allows us to safely contact you about your personal account information.

I’m a tier 4 and would like to retire after 20 years. I’ll be 53 years old. How will that affect my retirement?

Tier 4 members can receive their full retirement benefit at age 62 or retire as early as age 55 with less than 30 years of service and receive a reduced benefit. Depending on your plan, it’s likely that you would not be able to retire and collect a pension at age 53.

If you chose to leave public employment, you would be able to apply for a vested retirement benefit once you turn 55. However, leaving public payroll before you are eligible to retire may affect your eligibility for certain death benefits and health benefits.

If you are considering leaving public payroll before age 55, we suggest you email our customer service representatives using the secure email form on our website to ask how it would affect your pension benefits. Filling out the secure form allows them to safely contact you about your personal account information.

You may also wish to speak to your health benefits administrator to find out how going off payroll would affect any post-retirement health benefits you may be entitled to.

If you were out sick for 2 months without pay , would you receive credit fo that time in the retirement system.

Employees who are not working and are not being paid by their employer do not earn service credit toward retirement.

For account-specific information, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.