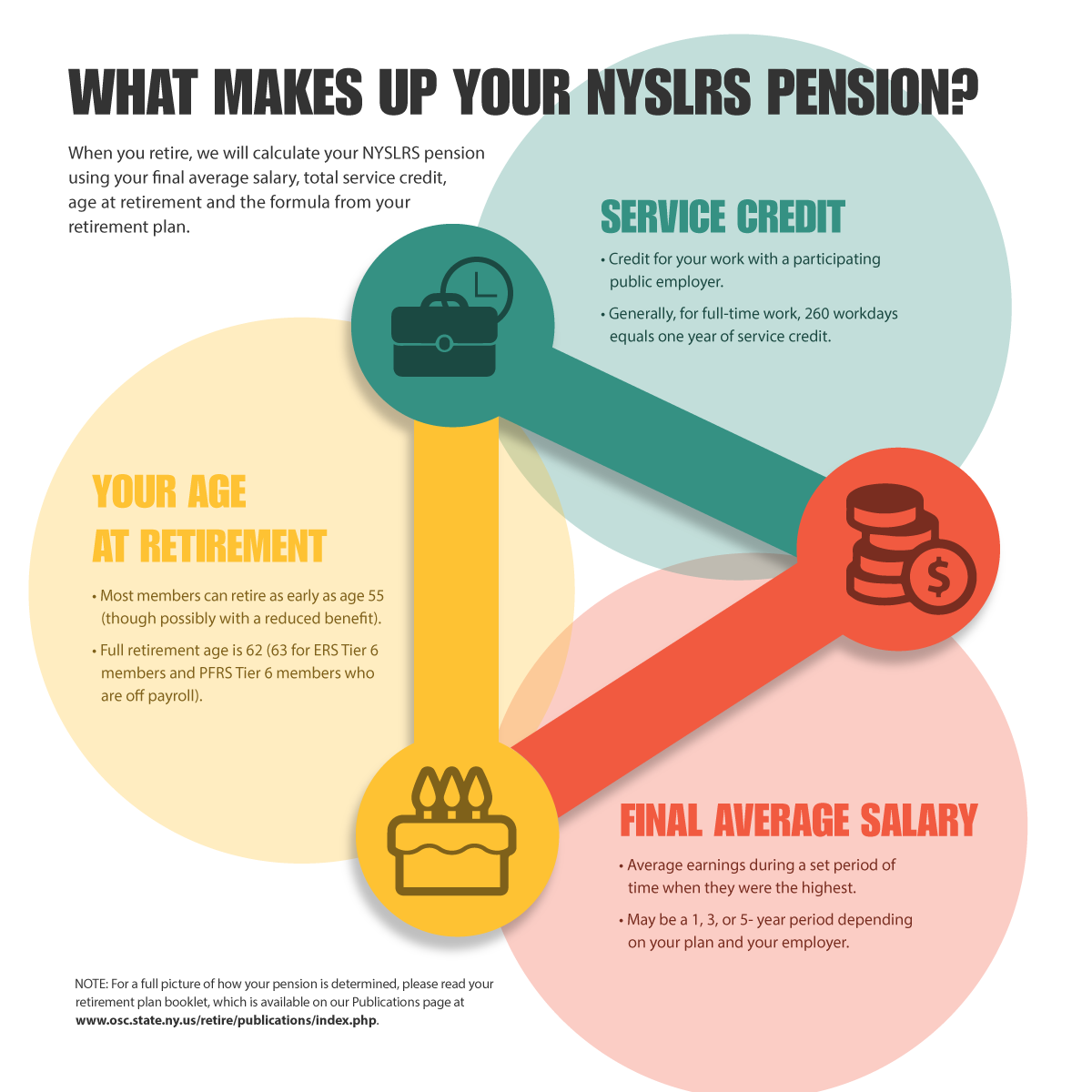

Generally, three main components determine your NYSLRS pension: your retirement plan, your final average salary (FAS) and your total service credit.

Your Retirement Plan

NYSLRS retirement plans are established by law. Your plan lays out the formula we’ll use to calculate your pension as well as eligibility requirements. It’s important to read your plan booklet, which you can find on our Publications page. If you aren’t certain what retirement plan you’re in, check your Member Annual Statement or ask your employer.

Final Average Salary

Your FAS is the average of your earnings during the set period of time when they were the highest. For ERS and PFRS members in Tiers 1 through 5, that period is three consecutive years; for Tier 6 members, it’s five consecutive years. Some PFRS members may be eligible for a one-year period, if their employer offers it. We will use your FAS, age at retirement, total service credit and the formula from your retirement plan to calculate your NYSLRS pension.

Generally, the earnings we can use for your FAS include regular salary, overtime and recurring longevity payments earned within the period. Some payments you receive won’t count toward your FAS, even when you receive them in the FAS period. The specifics vary by tier, and are listed in your retirement plan booklet.

In most cases, the law also limits how much your pensionable earnings can increase from year to year in the FAS period. Earnings above this cap will not count toward your pension.

Our Your Retirement Benefits publications, (ERS and PFRS), provide the limits for each tier and examples of how we’ll determine your FAS.

Service Credit

Service credit is credit for time spent working for a participating public employer. For most members who work full-time, 260 workdays equals one year of service credit. Members who work part-time or in educational settings can refer to their retirement plan publication for their service credit calculation.

Service credit is a factor in the calculation of your NYSLRS pension. Generally, the more credit you have, the higher your pension will be. Some special plans (usually for police officers, firefighters or correction officers) let you retire at any age once you’ve earned 20 or 25 years of service credit. In other plans, if you retire without enough service credit and don’t meet the age requirements of your retirement plan, your pension will be reduced.

Planning Ahead for Your NYSLRS Pension

As you get closer to retirement age, keep an eye on your service credit and FAS. Make sure we have an accurate record of your public employment history. You can sign in to Retirement Online or check your latest Member Annual Statement to see the total amount of service credit you’ve earned. You may also want to take a look at our budgeting worksheet or try our Benefit Projector Calculator as you plan for your retirement.

If you have questions, or want to find out more information about what makes up your NYSLRS pension, please contact us.

I’m in a union, and I’m wondering if my FAS is based on my three years of salary from Jan. to Dec. of each year?….or is it based on my salary from the contract year?

Your final average salary is not limited to a calendar year or a contract year. A three-year FAS is the average of your earnings during any 36 consecutive months of service when they were highest. Usually, this period is the last three years of employment immediately before your retirement date, but it doesn’t have to be.

If you have questions about your particular situation, please email our customer service representatives using our secure email form. One of our representatives will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

Can I work for the same municipality after I retire? 68 Years Of Age, collecting my pension.

For information about your specific situation, we recommend emailing our customer service representatives using our secure email form. One of our representatives will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

If you return to public employment, there is generally no restriction on your earnings beginning in the calendar year you turn 65, unless you retired under a disability retirement, or you are returning to a public office.

For more information, see our publication, Life Changes: What If I Work After Retirement?.

Can I transfer my 6 years with NJ pension over to new york?

Only memberships in other New York State public retirement systems are eligible for transfer to NYSLRS. The other New York State public retirement systems are:

· New York State Teachers’ Retirement System

· New York City Employees’ Retirement System

· New York City Teachers’ Retirement System

· New York City Police Pension Fund

· New York City Fire Department Pension Fund

· New York City Board of Education Retirement System

· Metropolitan Transportation Authority Police Pension Fund

For more information about transferring membership, check out our Transferring or Terminating Your Membership page.

I’m a tier 6 and 54 with 4.2 years . What will I get after 10 years

That depends on your retirement plan and the date you intend to retire. For the account-specific information you need, please email our customer service representatives using our secure email form and let them know what date of retirement you are considering. One of our representatives will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

I work for town of parish highway Dept…I’m tier 5 .. what would the difference be between retirement at 59 with 20 years and 62 with 23 years service credits??

That depends on your earnings, and unfortunately, the NYSLRS Social Media team does not have access to your personal account information.

Assuming you’re in the Employees’ Retirement System, you can find your pension calculation information in the Service Retirement Benefit section of your Tier 5 retirement plan book. At age 59, you would have an 18.33 percent reduction. At age 62 you would have no reduction.

To get account-specific information, you can email our customer service representatives using our secure email form (http://www.emailNYSLRS.com), and one of our representatives will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.